The Challenge

A banking institution processes millions of transactions daily, including deposits, withdrawals, and fund transfers. With the rise of sophisticated financial fraud, the bank needs a robust solution to detect and prevent fraudulent activities in real-time.

Our Solution

Sigma Transaction Monitoring integrates seamlessly into the bank’s core banking system, continuously monitoring all transactions and analyzing them for suspicious activities such as:

Sigma acts as a critical intermediary between banks and settlement system providers, ensuring that fraudulent transactions are detected and stopped before they are processed.

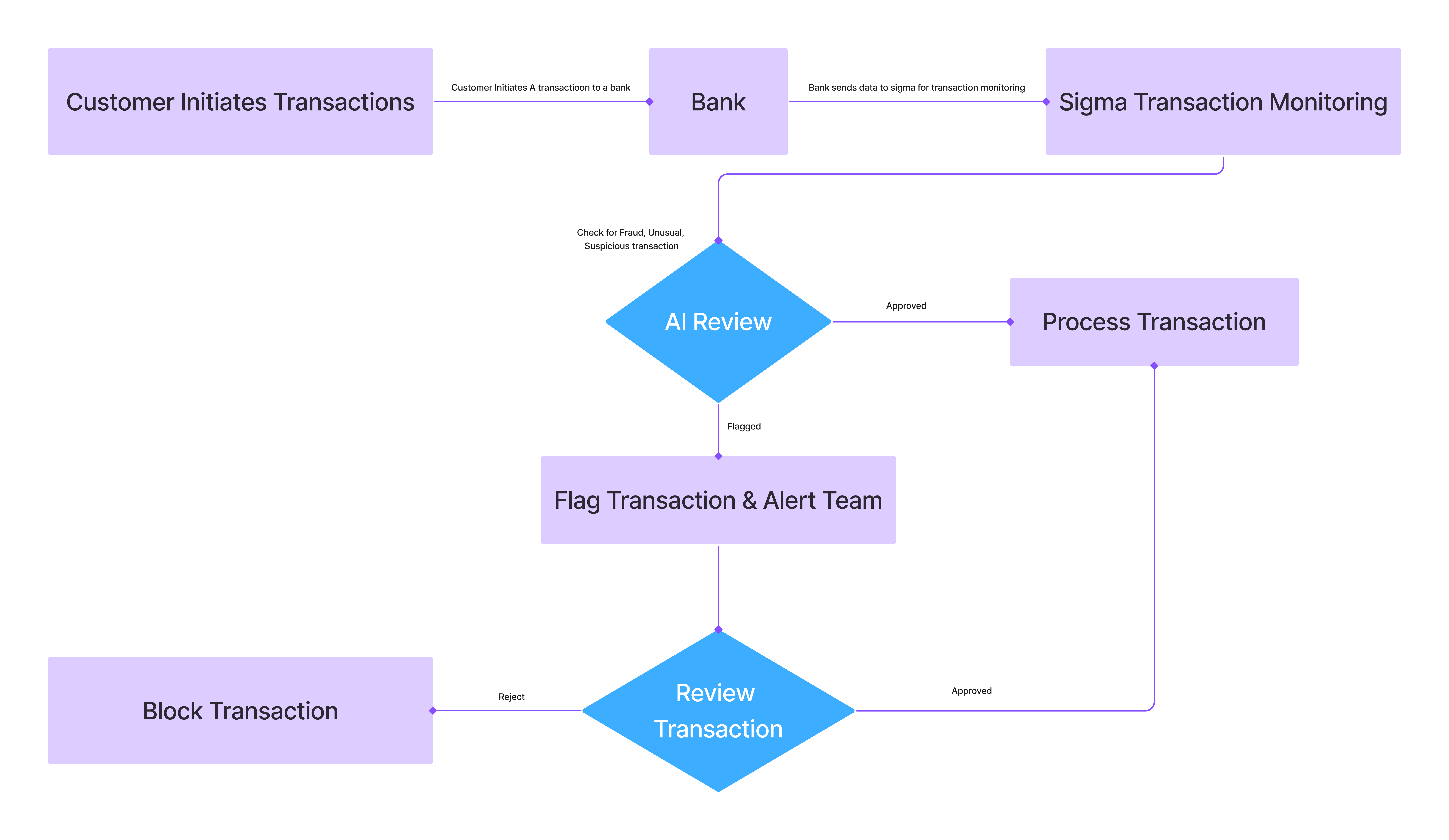

How It Works

Customer initiates a transaction at the bank

Bank routes the transaction through Sigma for real-time fraud analysis

Sigma evaluates the transaction using AI-driven models and rules

Sigma provides a decision recommendation to the bank

Decision Outcomes

Approve

If the transaction is deemed legitimate, Sigma recommends approval, and the bank forwards it to the settlement provider for processing.

Reject

If the transaction exhibits high fraud risk or violates a specific rule, Sigma advises rejection, preventing further processing.

Manual Review

If the transaction contains suspicious but inconclusive risk patterns, Sigma flags it for manual review by the bank’s fraud team.